Is PayPal’s Working Capital Program a Mistake?

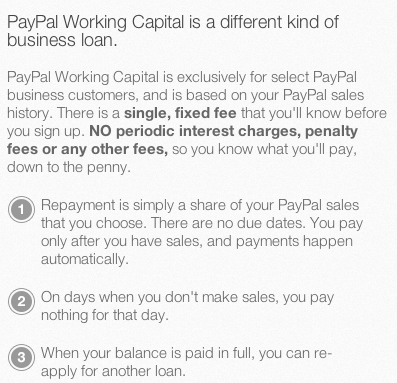

A few weeks ago, PayPal announced the launch of their Working Capital program as a way to help small businesses in need. They classify it as a loan but the explanation for how it works is textbook merchant cash advance. A percentage of each PayPal sale is withheld and applied as a reduction to the merchant’s balance. PayPal joining the booming merchant cash advance/alternative lending market is really no surprise. After all, RapidAdvance just got acquired by the same group that owns Quicken Loans. We’re in a new era of alternative finance.

A few weeks ago, PayPal announced the launch of their Working Capital program as a way to help small businesses in need. They classify it as a loan but the explanation for how it works is textbook merchant cash advance. A percentage of each PayPal sale is withheld and applied as a reduction to the merchant’s balance. PayPal joining the booming merchant cash advance/alternative lending market is really no surprise. After all, RapidAdvance just got acquired by the same group that owns Quicken Loans. We’re in a new era of alternative finance.

PayPal is respected as a payments company but are they ready for the high risk world of merchant cash advance financing? Critics are not so sure. Industry insiders have watched dozens of funding providers jump into the market with aggressive rates, attempt to undercut the competition, and acquire a lot of marketshare. The results are usually disastrous.

For years, journalists believed that the high cost of capital provided by non-bank lenders was fueled by the desire for immense profit. They didn’t understand the risks involved or realize that some funding providers weren’t even turning a profit at all. Last year, Opportunity Fund, a non-profit small business lender revealed that to make loans at 12% APR would fail to even cover costs. The for-profit sector of the industry charges factor rates (different than Annual Percentage Rates) between 1.14 and 1.50, not including fees. I explained this variance once before in The Fork in the Merchant Cash Advance Road.

So did PayPal learn anything from an industry that has been in existence for 15 years? It doesn’t look like it:

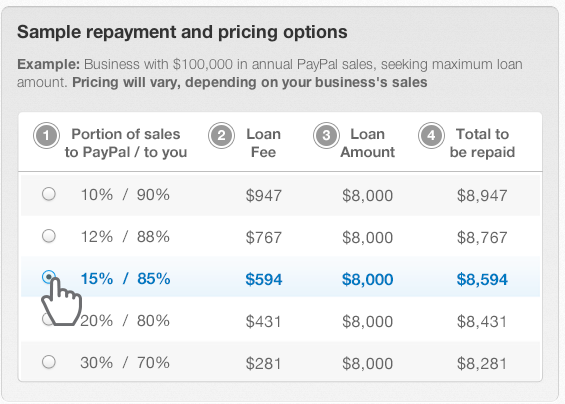

Doing some simple math (Total to be repaid / Loan Amount), the factor rates range from 1.04 to 1.12, figures that will probably only make sense if their average client has greater than 720 FICO, many years in business, and is virtually perfect on paper and in reality. Perhaps PayPal knows that and will decline 95% of applications or perhaps they believe their clients will buck the trend. I mean, is it possible that a corporate monster like PayPal could make a boneheaded mistake?

A 1.04 deal? Seriously? This has disaster written all over it. There are some people that believe that the losing proposition is intentional…

You can follow the discussion about this on DailyFunder.

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.